VITALII BORKOVSKYI/iStock via Getty Images

paper

The meta platform appears (NASDAQ: Meta) as an opportunity of value. And I have argued many times that the market is underestimating the earnings potential of the social media giant. It attracts investors and speculators alike. In the framework of that criterion, I do not intend to associate Meta investors with gambling premonitions. add to the value.

This article presents three “speculative” opportunities. If it does, it could boost Meta stock. Second, his use of TikTok may be banned in Western countries due to data/privacy issues. Third, Meta has put its technology and software engineering “talent” to good use, A.I.

Previously, we discussed Meta’s recently announced subscription strategy (see here) and also assigned strong buying recommendations. Compared to the subscription discussion, this article is a conceptual analysis of speculative considerations that have yet to be fleshed out.

Zuckerberg’s Metaverse Ambitions Could Succeed

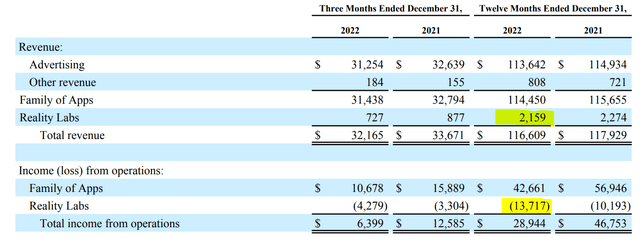

In fiscal 2022, Meta lost nearly $13.7 billion to develop Zuckerberg’s Metaverse ambitions. That’s a breathtaking amount, and if it goes to shareholders in the form of profits, it could increase Meta’s market cap by an estimated $150 billion to his $200 billion (depending on the assumed multiplier) ). So it’s no surprise that many analysts and investors oppose the metaverse “opportunity.”

Meta Q4 2022 Report

However, investors should consider the market cap valued at $450 billion. Meta investors are no longer paying for Zuckerberg’s Metaverse ambitions. Still, investors could reap the economic benefits if his $10 billion to $15 billion annual R&D investments are successful in realizing new market and product opportunities.

Personally, I continue to believe that Zuckerberg’s metaverse ambitions make sense in the context of “immersive communication,” which sooner or later inevitably develops.Or at Mark Zuckerberg own words:

When I started in 2004, text was the primary medium for people to share online. Then I got a phone with a camera, but it was mostly photography and now video. But this is not the end. There is something after text, photos and videos. Communication is becoming more and more immersive.

Like the internet revolution that began in the early 1990s, the metaverse revolution can It has the potential to change the way people interact, learn, seek entertainment and spend money. Additionally, Zuckerberg isn’t tackling something completely absurd, but rather referring to what avant-garde thinkers have long conceptualized: “Snow Crash,” “The Matrix,” and “Ready Player One.” I claim.

TikTok May Be Banned

I have previously argued that TikTok is not much of a threat to Meta, as many analysts perceive it to be. The TikTok discussion is therefore still relevant.

Investors should consider that more than 30 states in the US have banned the use of TikTok on government-related devices. European and Canadian authorities have also implemented similar bans. Now, as tensions between China and the West continue to worsen, TikTok becomes more and more likely. But while he’s likely less than 10% likely that TikTok will be banned outright within the next 24 months, the event has some noteworthy speculative value.

For reference, investors should consider that many tech companies, including Meta, are banned from doing business in China. So why shouldn’t the same policy be pushed in reverse?

Meta’s commitment to AI

AI, it’s the foundation of our discovery engine and advertising business. We also believe it will enable further transformation of many new products and apps. Generative AI is a very exciting new field with so many different applications. One of my goals at Meta is to advance our research to become a leader in generative AI. In addition to our major efforts in recommendation AI,

— Mark Zuckerberg on the Fourth Quarter 2022 Earnings Conference Call (emphasis added)

Another reason why meta platforms offer speculative value is that they leverage the “talent” of technology and software engineering to [generative] A.I. While the market has plenty of room for Microsoft (MSFT), Baidu (BIDU) and NVIDIA (NVDA), punished With Google (GOOG)’s unsuccessful attempt to launch Bard, I still believe the potential of Meta Platforms is underestimated.

Investors should consider that Zuckerberg only recently announced the formation of a dedicated AI team developing AI-related products for Instagram and WhatsApp.

At Meta, we are accelerating our work in this area by creating a new top-tier product group focused on generative AI.

add it

There’s a lot of basic work that needs to be done before we can get to the truly futuristic experience, but I’m excited about all the new things that will be built along the way.

More specifically, Zuckerberg commented that Meta is exploring opportunities around how AI can support society. [research]-AI-supported product features such as chatbots for Messenger and WhatsApp, and filters and ad formats for Instagram and Facebook.

Meta, in particular, has already announced its own “chatbot” called LLaMA. According to Meta, LLaMA is very different from OpenAI’s ChatGPT. Meta’s technology utilizes publicly accessible datasets such as Common Crawl, Wikipedia, and C4 to train its AI. This could make Meta’s training process more transparent, as common sense suggests, and make the model available as an open-source resource.

To build a more conceptual argument, I would also like to highlight how AI can support Zuckerberg’s metaverse ambitions. The combination of generative AI and the metaverse has the potential to significantly improve user experience across multiple frontiers. For example, by building realistic human interactions using AI language models, or by modeling virtual environments.

Conclusion

In 2022, Meta has accumulated approximately $34 billion in operating income and has repurchased $32 billion worth of shares. Therefore, Meta’s market cap of around $450 billion looks cheap compared to its fundamentals. But the “undervalued” debate goes beyond fundamentals. In fact, I believe the market is underestimating the speculative potential of Meta. Specifically, we see three “speculative” opportunities that, if realized, could boost Meta’s stock price. Second, his use of TikTok may be banned in Western countries due to data/privacy issues. Third, Meta successfully leverages its technology and software engineering “talent” to market new AI opportunities.

Meta platform continues to be a ‘strong buy’.