It’s been a trying year for Mark Zuckerberg and his social media company Meta. Meta will increase his quarterly earnings in July 2022, even though market value peaked at his $1.1 trillion in August 2021 due to increased online activity during the COVID-19 pandemic. revenues faced a decline for the first time in history.

This was followed three months later by another drop, raising concerns among investors about Zuckerberg’s decision to invest $10 billion annually in the untested metaverse world. The company’s market value had fallen 60% by November, and 11,000 employees, or his 13% of employees, had been laid off.

Sales Decline, Optimism Increases

On February 1, Meta reported a 4.5% year-on-year decline in sales in the last three months of 2022. Although the decline was smaller than expected, the company remains optimistic about the current quarter, expecting revenue to reach $28.5 billion. That’s higher than he did in the first three months of 2021, before Apple’s privacy rules on iDevices made it more difficult for advertisers to track their online customers.

Zuckerberg said expenses are being carefully managed and the company plans to cut less profitable or less critical projects more aggressively. The company also announced that he plans to buy back $40 billion worth of his Meta stock.

In even better news for Meta, a judge in California has dismissed a lawsuit filed by the Federal Trade Commission against Meta’s acquisition. internalis a leading producer of virtual reality fitness apps.

Investors responded positively to the news. Meta’s share price recently rose another 20% after his share price rose 70% in the last three months. That brings the market cap to his $484 billion mark, signaling a possible comeback for the struggling tech giant.

Despite the challenges, Zuckerberg remains optimistic. Meta is finding ways to circumvent his Apple privacy regulations, and its artificial intelligence capabilities are advancing. Especially in “Reel”, the algorithm distributes short videos on his Instagram and Facebook, which are Meta’s main sources of revenue. This is his response to short-form video platform TikTok.

tik tok boom

TikTok is rapidly gaining a large following, especially among young people, due to its short-form video format and entertaining content. This has forced Facebook to find new ways to attract and retain users, especially younger users.

To compete with TikTok, Facebook has introduced new features such as Reels, a short-form video platform that mimics TikTok’s style, and integrates Instagram with similar videos in its main Facebook app.

Still, TikTok has distinct advantages over Meta’s Facebook. TikTok is a standalone platform, largely unaffected by a history of privacy scandals and other controversies. To compete, Facebook must offer similar features and address privacy and data security issues.

Chinese-owned TikTok also faces scrutiny in the United States. Some lawmakers have called for a boycott of the app, citing national security concerns.

There are obstacles beyond TikTok. The once stable digital advertising market has become more cyclical and the economic outlook is uncertain. Advertisers may be more cautious with their spending even if the western world in the meta avoids a recession. Worse, spend it with meta rivals.

And despite calls for a TikTok ban, it’s unlikely that Washington will take legislative action.

Meta still faces challenges from domestic regulators, with another FTC lawsuit seeking its split. Europe is drafting strict regulations for large digital agencies.

Perhaps most importantly, few people are enthusiastic about moving to the metaverse. This is evident in the decline in users of Horizon Worlds, Meta’s main virtual world attraction, at the end of last year.

Other virtual worlds already have billions of players

Meta faces an even bigger challenge when it comes to competing in the metaverse market. The existing (and thriving) virtual world already hosts billions of players his accounts in the top 10 games.

There will always be 2.5 billion gamers in these virtual realms. This number exceeds the number of Facebook, Instagram and WhatsApp users combined.

Tencent dominance

The top three virtual worlds with 3.5 billion player accounts, Player’s Unknown Battlegrounds, Crossfire and Dungeon Fighter, Tencentthe world’s largest game company.

Tencent owns WeChat, QQ, and Spotify, and offers a large-scale online social payment system that Meta does not. Tencent also runs Fortnite’s largest online virtual concert, and also owns 40% of Epic, which has 350 million players.

Minecraft and Roblox lead the way

Microsoft’s Minecraft has 600 million players, making Microsoft the fifth largest gaming company in the world. With the Xbox console, Microsoft HoloLens, and their vision for the Metaverse, even Microsoft is well ahead of Meta.

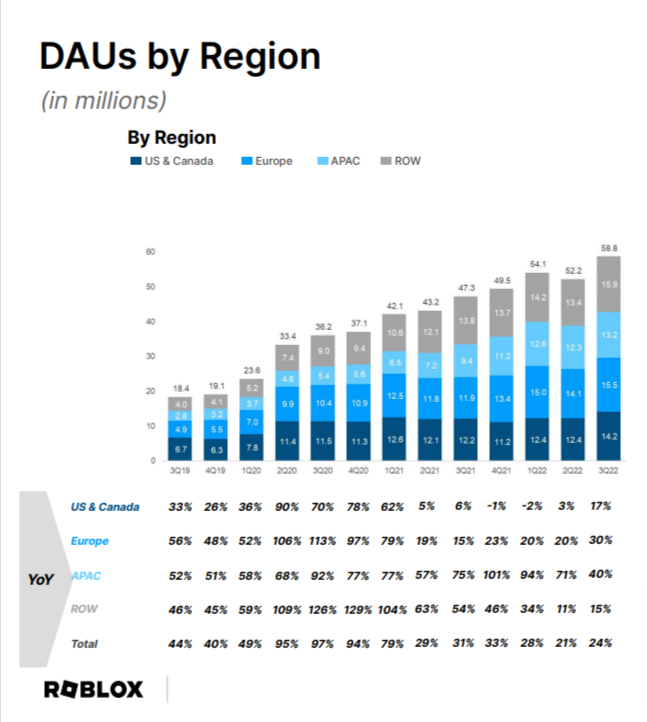

another metaverse, roblox, surpasses the meta. Today, 50% of US 9-12 year olds play Minecraft or Roblox. This poses a threat to future adoption of Meta’s metaverse. Roblox has grown to nearly 60 million players daily.

Meanwhile, Meta’s Oculus, Horizon Home, Horizon Worlds, and Horizon Workrooms have just 5 million users.

This means that meta faces significant challenges in the rapidly growing metaverse market. The Metaverse already boasts a huge player base, led by games like Minecraft, Roblox, Tencent’s Crossfire, PUBG, and Dungeon Fighter.

Additionally, the Metaverse is built on engines such as Unity and Unreal Engine, both of which are multi-billion dollar businesses with thousands of projects in development. Meta’s Horizon Worlds is built on the Unity engine, not in-house.

social networks are key

Meta faces stiff competition from platforms like TikTok and Pinterest. Meta must evolve and adapt to remain relevant and competitive while addressing privacy and security concerns. And we focus on providing a visually appealing and engaging user experience.

Meta’s ability to successfully navigate these challenges will determine its future success in the social media market.

The dominance of Microsoft, Tencent, Roblox, and Unity threatens Meta’s aspirations for the metaverse. These companies have established a strong foothold in the virtual reality market and have the resources and expertise to continue to innovate in this space.

Given the current situation, it may be difficult for Meta to gain a significant market share. It also needs to keep growing its revenue through its lucrative Facebook and Instagram platforms to fund Zuckerberg’s grandiose metaverse vision.

Disclaimer

All information contained on our website is published in good faith and is for general information purposes only. Readers are strictly at their own risk for any actions they take with respect to information they find on our website.