Meta to eliminate another 10,000 jobs

Meta, owner of social media platforms Facebook and Instagram, has announced plans to cut another 10,000 jobs in the coming weeks and months. He also said he will be closing 5,000 open jobs as the pace of new hiring appears to be slowing.

This is the latest step taken after Meta CEO. When Meta released its annual results earlier this year, Mark Zuckerberg described 2023 as the “year of efficiency” and vowed to keep cracking down. Increased costs due to slower growth due to the sluggish advertising market.

New staff recruiters were the first to be affected and will discover the impact in the coming days. Technical department staff will find out their fate in “late April,” followed by business function staff in “late May.” .

This suggests that the restructuring could take months to complete, with Meta warning that a “small number of cases” could take until the end of 2023 to resolve.

Meta: Still lots of fat left to cut

This is the second job cut Meta has initiated since it announced last November that it would cut 11,000 jobs.

We are committed to these cuts even after announcing an additional 10,000 layoffs today.

Meta was one of the companies that over-enthusiasticly recruited when the opportunity arose during the recovery from the pandemic and its workforce. As the graph below shows, between the start of the pandemic and the end of 2022, Meta’s workforce has more than doubled his size. However, we can see that the Meta workforce will grow by about 46% before the pandemic hit, even after 21,000 jobs were cut this year.

(Source: company press release)

Still, Meta suggests the workforce could start growing again after saying it would “unhire and freeze transfers” once these job cuts are complete. Investors shouldn’t expect more jobs, as Meta has vowed to become a “sleeker, more tech company” and has confirmed it will be hiring new employees at a much slower pace than seen in recent years. increase.

Mehta said he plans to flatten the hierarchy and cut out unnecessary layers of management to speed up processes and improve work flow across the business. We also continue to lower the threshold from low-priority projects and reallocate valuable resources to other parts of our business.

Meta: Tougher situation could last ‘for years’

Meta, which has already warned that conditions will remain tough through 2023 and will continue to squeeze earnings, said today that it believes this “new economic reality will continue for years.”

“For most of our history, we had rapid revenue growth each year and had the resources to invest in many new products. But last year was a humble wake-up call. , the competitive pressure increased and our growth slowed significantly,” said Zuckerberg.

With growth struggling for the foreseeable future, the best thing Meta can do is to keep abreast of its costs and show it’s protecting profitability in these tough times. This will give you confidence that you can weather the storm and come back in better shape when you finally recover.

“Given this outlook, we need to operate more efficiently than previous job cuts to ensure success,” he added.

Meta refuses to reduce its investment in the metaverse

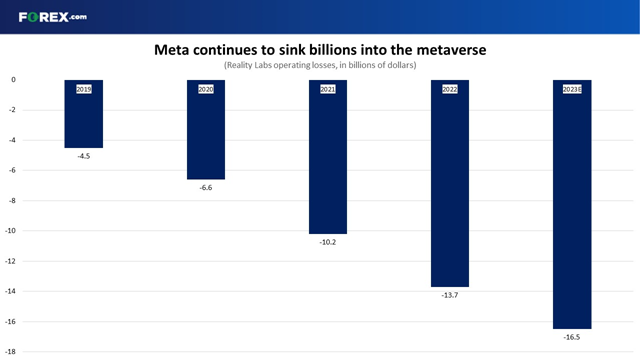

Meta found it difficult to convince the market that a large investment in the Metaverse would pay off. The Reality Labs unit, home of the Metaverse activity, said he would lose a staggering $13 billion in 2022, and billions more in 2023. Some analysts are calling on Meta to scale back or abandon its costly metaverse ambitions to focus on its core. He is going through one of the toughest times on record in the advertising business.

(Source: Company report)

Reducing investments here is the easiest way to protect our bottom line without impacting the business that drives Meta today, but it comes down to what we believe is a new long-term opportunity. You run the risk of losing leadership.

But Meta remains steadfast that its vision is worth pursuing, even if the near-term outlook looks bleak.

“In the face of this new reality, most companies will scale back their long-term vision and investments. But we have the opportunity to be bolder and make decisions that others cannot. That is why we have put together a financial plan that allows us to deliver sustainable results while making significant investments for the future, as long as we operate all our teams more efficiently. This will enable us to meet this financial plan,” said Zuckerberg.

Specifically, Meta said that its biggest investment right now is not in the Metaverse, but in artificial intelligence, which is used “in all of our products.”

“I think we have the infrastructure to do this on a scale never seen before, and the experiences it enables will be amazing. Work also plays a central role in defining the future of social connections, and our apps continue to grow and connect nearly half the world’s population in new ways. This work is very important and the stakes are high, and the financial plan we have set will allow us to make it happen,” said Meta.

What next for meta stocks?

Meta stocks rose more than 5% this morning on news of new job cuts.

The near-term upside target is to surpass the $191.62 closing price seen in February, and the stock has already tested this level in early trading today. From there, it could cross $202 before aiming for a bigger jump to $223, which represents the highs we saw last May and the peak we saw in early 2020 before the pandemic derailed financial markets.

Notably, the 58 brokers covering the stock see limited upside potential after the 2023 rally, with the average target price currently hovering at $209.

Additionally, the RSI is testing overbought territory today, suggesting that gaining more ground could become more difficult. There is still the possibility of a fall. Below this, the $155 lower bound seen in the third quarter of 2022 should provide some support.